WHAT DO YOU REALLY CARE ABOUT?

Wouldn't you rather think about that than

worry about your money all the time?

The 24-Day Retirement Planning Master Class E-course:

Q

Frequently Asked Questions

Q

Q

A

A

A

Copyright © 2015 Free Money Guys®

We offer several ways for you to learn what you can do.

Want to keep complete distance and anonymity but still learn as much as possible?

Take advantage of our local radio broadcasts or our podcast at FMGpod.com. Or if you prefer, you can purchase Steve's books, Tell Me When You're Going to Die, Retirement Planning Riches, and Safe Harbors That Can Reduce Taxes, Remove Risk, and Protect Your Retirement directly from Amazon.com.

Prefer a more immersive experience, but less than enthusiastic about a one-on-one meeting?

Take advantage of our online ecourses and ebooks right from the comfort of your home. Our eworkshop will deliver 24 five-minute videos right to your inbox, one each and every day, for 24 consecutive days. Watch them once, twice, or as many times as you like with no pressure and no time limit. Supplement them with our Safe Money Secrets e-book that is chock full of real world ideas and solutions that can help you have a more abundant retirement without incurring any more risk.

Want to have a more personal, but still insulated, experience?

Sign up for one of our informative, hands-on workshops in our state-of-the-art training center. You will experience the "strength-in-numbers" security of a group of other people with similar concerns in a setting that provides for deep insights into the complexities and possibilities of retirement income planning, conducted by Steve and Mark, the Free Money Guys® themselves!

®

Every Sunday at Noon, AM 980-WCAP, Lowell, MA

Every Tues. and Wed. at 9 a.m, AM 1590-WSMN, Nashua, NH

Or

Or

Discover. Plan. Execute. Review and Adjust.

Discover

Our planning process, crafted over 40 years of helping people achieve financial confidence and security, usually takes three, or sometimes four, meetings. It begins with a low-key, personal interview with one of the Free Money Guys® themselves. You are never shuffled off to an associate or assistant at any point in the process. During this interview you will have an opportunity to ask any questions you like; nothing is off limits. We will describe to you our detailed planning process, and together will come to a mutual agreement as to whether you meet our three criteria: are you coachable, can we help you, do we like each other?

Assuming all parties are comfortable moving forward, we begin your financial coaching program in earnest with a detailed fact-finding analysis. Many of our clients have told us this was the single most valuable stage of the entire program. Fact-finding employs proven interviewing techniques along with a detailed, in-depth and deceptively simple Wealth Index questionnaire that you perform at your own pace in the comfort of your home. It has been designed to produce the clearest understanding of your needs, wants, desires, fears, obstacles, and opportunities possible.

Next we meet to go over your Personal Wealth Index and discuss what each of us has learned from it. Your coach will probe areas that appear to be in conflict or less than clear. Once all parties achieve maximum clarity and an accurate understanding of your goals and objectives, we will begin to craft your plan using our state-of-the-art-tools. In total, discovery ordinarily takes one, sometimes two, meetings.

Plan

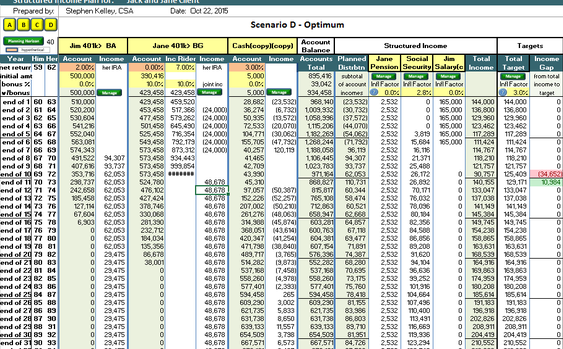

As we move through our planning time together, we will examine every piece of the puzzle. You will receive a customized Social Security analysis that will ensure you get the maximum benefit in the best way for your circumstances. If you have one, we will help you plan your pension so that it, too, provides maximum benefits for the rest of your life. We will examine your tax situation and potential healthcare needs. We'll help you identify as many potential threats to your retirement as we can and uncover every opportunity that is available to you.

You will emerge from the process with a clear understanding of what you need, why you need it, and your sources of income for each and every year of the rest of your life. Unlike some plans that sometimes span dozens of pages, your financial plan is delivered in our unique, two to three-page format that makes it simple to understand and easy to access. You will know, with confidence, how each component fits and works with all the others, why each strategy and tool is employed, and how each one benefits you. No longer will you have a hodge-podge of different products and accounts you don't understand or know why you have or how they fit together. Rather, you will have a cohesive plan that is structured to provide lifelong income but is flexible enough to bend as future circumstances require. Planning usually takes one to two sessions.

Execute

Then, and only then, will you be asked to make a determination to move forward with the contracting phase where you sign applications and authorizations for us to move your assets and perform the agreed-upon allocations. At contracting you become our actual clients, moving your assets to us to manage on your behalf, and employing us as your advisors. Executing is a two meeting process, the first signing, and the second, delivering and reviewing the contracts. Once delivered, you will have a 10 to 30-day free look period in which you will be able to change your mind without charges or penalties.

Review and Adjust

That's only the beginning. Each and every year there will be an annual review that is designed to compare the plan with what actually happened over time and to make adjustments as needed. We understand that the only constant in life is change. A plan is only as good as the way in which it is used, so we meet each and every year to ensure that you are achieving the intended results, and circumstances have not made your plan obsolete.

That's the Free Money Guys process. Discover, plan, execute and review and adjust. Together, so all parties have a clear understanding and common purpose.

Or Take Advantage of our Online Resources

®

Podcasts and Publications

Worried about running out of money? Concerned about market risk, taxes and inflation? High fees have you frustrated? Wondering how to get the most money out of your retirement accounts without taking an exorbitant amount of risk?

Syndicated “Free Money Guy”® radio personality, author, nationally known speaker and retirement planning guru Stephen Kelley reveals the retirement planning lessons Wall Street hopes you’ll never learn in his simple, straightforward, easily approachable style. Thought provoking, sometimes funny, always insightful, and never dull, Kelley's latest book, “Tell Me When You’re Going to Die, and I’ll Tell You How Well You Can Afford to Live” is a must-read for anyone preparing for, or already in retirement.

Click on any of the above books to be taken to our Amazon page.

Check out these free tools!

Are you considering an annuity purchase? Don't buy one until you've read this special report.